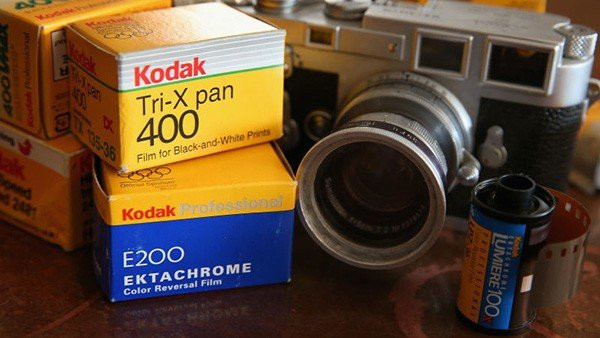

Στο παιχνίδι των μηνύσεων έχει μπει για τα καλά η Kodak, η οποία αφού κατέθεσε αγωγές κατά των Apple και HTC για καταπάτηση πατεντών, αποφάσισε αυτή τη φορά να κινηθεί δικαστικά εναντίον της Samsung.

Σύμφωνα με δελτίο τύπου της εταιρείας, η Kodak κατέθεσε νέα μήνυση κατά της Samsung για παραβίαση πέντε πατεντών σε θέματα ψηφιακής απεικόνισης. Πιο συγκεκριμένα, οι πατέντες αυτές έχουν να κάνουν με τεχνολογίες λήψης και μετάδοσης εικόνων, από την αποστολή εικόνων με email μέχρι τη μετάδοση ψηφιακών εικόνων μέσω δικτύου κινητής τηλεφωνίας.

Το πιο ενδιαφέρον όμως στην όλη υπόθεση είναι ότι την ίδια σχεδόν ώρα με την κατάθεση της μήνυσης, η Kodak υπέβαλε τα χαρτιά της για υπαγωγή στο Άρθρο 11 του αμερικανικού πτωχευτικού κώδικα, κάτι που της δίνει περιθώριο μέχρι το 2013 για να καταφέρει να ανακάμψει και να αποπληρώσει τα χρέη της.

Όπως όλα δείχνουν, για να επιτύχει κάτι τέτοιο η κάποτε επιτυχημένη εταιρεία φωτογραφικών προϊόντων έχει επιλέξει -τουλάχιστον μέχρι στιγμής- την εύκολη οδό των μηνύσεων. Θα καταφέρει έστω κι έτσι να ορθοποδήσει ή η τελευταία της μήνυση ήταν απλά ο επιθανάτιος ρόγχος της; Θα το διαπιστώσουμε σύντομα...

January 19, 2012 12:22 AM Eastern Time

Eastman Kodak Company and Its U.S. Subsidiaries Commence Voluntary Chapter 11 Business ReorganizationFlow of Goods and Services to Customers to Continue Globally in Ordinary Course

Non-U.S. Subsidiaries Are Not Included in U.S. Filing and Are Not Subject to Court Supervision

Company Secures $950 million in Debtor-in-Possession Financing in U.S.

Kodak's Reorganization to Facilitate Emergence as Profitable and Sustainable Enterprise

ROCHESTER, N.Y.--(BUSINESS WIRE)--Eastman Kodak Company ("Kodak" or the "Company") announced today that it and its U.S. subsidiaries filed voluntary petitions for chapter 11 business reorganization in the U.S. Bankruptcy Court for the Southern District of New York.

"Our goal is to maximize value for stakeholders, including our employees, retirees, creditors, and pension trustees. We are also committed to working with our valued customers."

The business reorganization is intended to bolster liquidity in the U.S. and abroad, monetize non-strategic intellectual property, fairly resolve legacy liabilities, and enable the Company to focus on its most valuable business lines. The Company has made pioneering investments in digital and materials deposition technologies in recent years, generating approximately 75% of its revenue from digital businesses in 2011.

Kodak has obtained a fully-committed, $950 million debtor-in-possession credit facility with an 18-month maturity from Citigroup to enhance liquidity and working capital. The credit facility is subject to Court approval and other conditions precedent. The Company believes that it has sufficient liquidity to operate its business during chapter 11, and to continue the flow of goods and services to its customers in the ordinary course.

Kodak expects to pay employee wages and benefits and continue customer programs. Subsidiaries outside of the U.S. are not subject to proceedings and will honor all obligations to suppliers, whenever incurred. Kodak and its U.S. subsidiaries will honor all post-petition obligations to suppliers in the ordinary course.

"Kodak is taking a significant step toward enabling our enterprise to complete its transformation," said Antonio M. Perez, Chairman and Chief Executive Officer. "At the same time as we have created our digital business, we have also already effectively exited certain traditional operations, closing 13 manufacturing plants and 130 processing labs, and reducing our workforce by 47,000 since 2003. Now we must complete the transformation by further addressing our cost structure and effectively monetizing non-core IP assets. We look forward to working with our stakeholders to emerge a lean, world-class, digital imaging and materials science company."

"After considering the advantages of chapter 11 at this time, the Board of Directors and the entire senior management team unanimously believe that this is a necessary step and the right thing to do for the future of Kodak," Mr. Perez continued. "Our goal is to maximize value for stakeholders, including our employees, retirees, creditors, and pension trustees. We are also committed to working with our valued customers.

"Chapter 11 gives us the best opportunities to maximize the value in two critical parts of our technology portfolio: our digital capture patents, which are essential for a wide range of mobile and other consumer electronic devices that capture digital images and have generated over $3 billion of licensing revenues since 2003; and our breakthrough printing and deposition technologies, which give Kodak a competitive advantage in our growing digital businesses."

Mr. Perez concluded, "The Board of Directors, the senior management team and I would like to underscore our appreciation for the hard work and loyalty of our employees. Kodak exemplifies a culture of collaboration and innovation. Our employees embody that culture and are essential to our future success."

Kodak has taken this step after preliminary discussions with key constituencies and intends to work toward a consensual reorganization in the best interests of its stakeholders. Kodak expects to complete its U.S.-based restructuring during 2013.

The Company and its Board of Directors are being advised by Lazard, FTI Consulting Inc. and Sullivan & Cromwell LLP. In addition, Dominic DiNapoli, Vice Chairman of FTI Consulting, will serve as Chief Restructuring Officer to support the management team as to restructuring matters during the chapter 11 case.

More information about Kodak's Chapter 11 filing is available on the Internet atwww.kodaktransforms.com. Information for suppliers and vendors is available at (800) 544-7009 or (585) 724-6100.

Kodak will be filing monthly operating reports with the Bankruptcy Court and also plans to post these monthly operating reports on the Investor Relations section of Kodak.com. The Company will continue to file quarterly and annual reports with the Securities and Exchange Commission, which will also be available in the Investor Relations section of Kodak.com.

![Kodak Ektra: Το εντυπωσιακό cameraphone διαθέσιμο και στην Ελλάδα [Video] Kodak Ektra: Το εντυπωσιακό cameraphone διαθέσιμο και στην Ελλάδα [Video]](https://techgear.cachefly.net/portal-img/art_def/11/imported-kodak-ektra-smartphone-2.jpg)